Uber Technologies Inc. and a subsidiary have submitted a $100 million payment to the New Jersey Department of Labor and Workforce Development’s (NJDOL’s) Unemployment Trust Fund after an audit found the ride-share companies improperly classified hundreds of thousands of drivers as independent contractors, depriving them of crucial safety-net benefits such as unemployment, temporary disability, and family leave insurance, and failed to make required contributions toward unemployment, temporary disability, and workforce development.

Copyright

(c) 2010-2024 Jon L Gelman, All Rights Reserved.

Showing posts with label benefits. Show all posts

Showing posts with label benefits. Show all posts

Wednesday, September 14, 2022

Monday, January 25, 2021

"Made in America" Will Impact Workers' Compensation Nationally

Today, President Biden signed the Executive order, Made in America.” The effort to move manufacturing jobs back to the United States will have a major impact going forward for the entire workers' compensation system. This initiative will expand the workforce and expand the potential of a major increase in workers' compensation benefits through increased wages/rates and premiums paid for coverage and all related cottage industries involved in the social insurance program.

Friday, November 20, 2020

Underpayment of Wages Impact Workers’ Compensation Claims

The underpayment of wages due workers impacts the calculation of benefits that injured workers and their dependents receive. States are now enforcing laws when inadequate wages have been paid workers.

Tuesday, September 22, 2020

NJ "Hand and Foot" Clarification Bill Advances

The New Jersey Senate Budget and Appropriations Committee has advanced legislation S2722 that clarifies the effective date of the recently enacted hand or foot bill, of P.L.2019, c.387, to include cases pending, but not yet settled or filed after the date of enactment. That legislation increased benefits to injured workers.

Tuesday, January 21, 2020

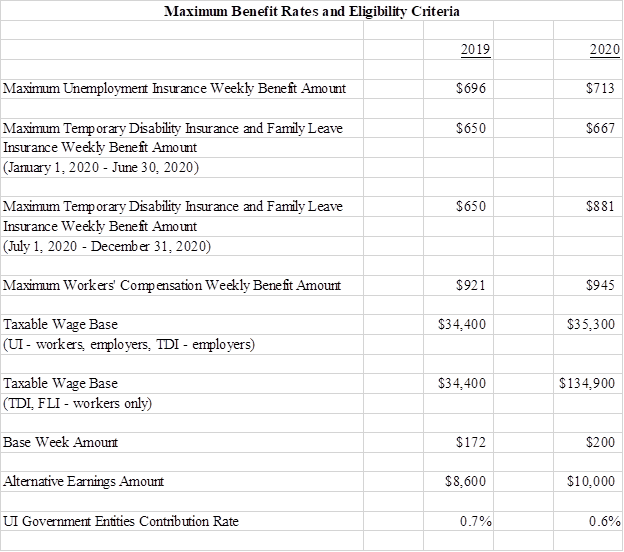

NJ Announces Increases in Maximum Benefit Rates & Taxable Wage Base

The New Jersey Department of Labor and Workforce Development (NJDOL) announced increases in the maximum benefit rates and taxable wage base as of January 1 for its Unemployment Insurance, Temporary Disability Insurance, Family Leave Insurance, and Workers’ Compensation programs.

On January 1, the maximum weekly benefit amount for Unemployment Insurance beneficiaries increased to $713, from $696. The maximum weekly benefit for state plan Temporary Disability and Family Leave Insurance claims increased to $667, from $650, while the maximum weekly benefit for Workers’ Compensation rose to $945, from $921.

The maximum benefit rates and the taxable wage base are recalculated each year based on the statewide average weekly wage, in accordance with the laws governing these programs. The benefit rates and taxable wage base for 2020 reflect the $1,259.82 average weekly wage for 2018, which rose by 2.6 percent from $1,228.25 in 2017.

The level of wages subject to wage taxes in 2020 increased to $35,300 for employers covered under the Temporary Disability Insurance program and for workers and employers covered under the Unemployment Insurance program, the Workforce Development Partnership Program, and Supplemental Workforce Fund for Basic Skills.

Additionally, a law enacted last year (P.L. 2019, chapter 37) increased the level of wages subject to wage taxes effective January 1 for workers covered under the Temporary Disability and Family Leave Insurance programs to cover significant increases in these benefits that go into effect later this year, including a higher maximum benefit rate and an extension in the maximum amount of leave available. The taxable wage base is $134,900 for 2020 for workers contributing to these programs, up from $34,400, or 107 times the statewide average weekly wage, up from 28 times the average weekly wage.

The increase in the maximum weekly benefit rate for Temporary Disability and Family Leave Insurance claims starts July 1, with an increase to $881 from $667. This represents 70 percent of the statewide average weekly wage, up from 53 percent of the average weekly wage. Additionally, the maximum amount of continuous leave will increase to 12 weeks, up from six weeks, and the maximum amount of intermittent leave will increase to 56 days, up from 42 days.

To qualify for Unemployment, Temporary Disability, or Family Leave benefits this year, an applicant must have earned at least $200 per week for 20 base weeks, or alternatively, have earned at least $10,000 during the base weeks. Benefit eligibility criteria are based on the state minimum wage in effect on October 1, 2019, when the minimum wage in New Jersey was $10/hour for most employees.

The contribution rate for state and local government entities that choose to make contributions rather than reimburse the trust fund for Unemployment Insurance benefits paid to their former employees, decreased to 0.6 percent of taxable wages during calendar year 2020, down from 0.7 percent in 2019.

Below is a chart showing the 2019 rates and the changes taking place January 1 and July 1:

To read more about "rates" and workers' compensation, click here.

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Saturday, June 15, 2019

Firefighter and Public Safety Officer Presumption Bill Advances

Firefighter and public safety officer presumption bill advances and creates a rebuttable presumption of workers’ compensation coverage for public safety workers and other employees in certain circumstances.

The bill affirms that if, in the course of employment, a public safety worker is exposed to a serious communicable disease or a biological warfare or epidemic-related pathogen or biological toxin, all care or treatment of the worker, including services needed to ascertain whether the worker contracted the disease, shall be compensable under workers' compensation, even if the worker is found not to have contracted the disease. If the worker is found to have contracted a disease, there shall be a rebuttable presumption that any injury, disability, chronic or corollary illness or death caused by the disease is compensable under workers' compensation.

The bill affirms workers’ compensation coverage for any injury, illness or death of any employee, including an employee who is not a public safety worker, arising from the administration of a vaccine related to threatened or potential bioterrorism or epidemic as part of an inoculation program in connection with the employee’s employment or in connection with any governmental program or recommendation for the inoculation of workers.

The bill creates a rebuttable presumption that any condition or impairment of health of a public safety worker which may be caused by exposure to cancer-causing radiation or radioactive substances is a compensable occupational disease under workers' compensation if the worker was exposed to a carcinogen, or the cancer-causing radiation or radioactive substance, in the course of employment. Employers are required to maintain records of instances of the workers deployed where the presence of known carcinogens was indicated by documents provided to local fire or police departments under the “Worker and Community Right to Know Act,” P.L.1983, c.315 (C.34:5A-1 et seq.) and where events occurred which could result in exposure to those carcinogens.

In the case of any firefighter with seven or more years of service, the bill creates a rebuttable presumption that, if the firefighter suffers an injury, illness or death which may be caused by cancer, the cancer is a compensable occupational disease.

The bill provides that, with respect to all of the rebuttable presumptions of coverage, employers may require workers to undergo, at employer expense, reasonable testing, evaluation and monitoring of worker health conditions relevant to determining whether exposures or other presumed causes are actually linked to the deaths, illnesses or disabilities, and further provides that the presumptions of compensability are not adversely affected by failures of employers to require testing, evaluation or monitoring.

The public safety workers covered by the bill include paid or volunteer emergency, correctional, fire, police and medical personnel.

This bill was pre-filed for introduction in the 2018-2019 session pending technical review. As reported, the bill includes the changes required by technical review, which has been performed.

The following bill(s) have been scheduled for a committee or a legislative session.

The following bill(s) have been scheduled for a committee or a legislative session.

A1741:

Quijano, Annette/Benson, Daniel R./Lagana, Joseph A.

"Thomas P. Canzanella Twenty First Century First Responders Protection Act"; concerns workers' compensation for public safety workers.

6/20/2019 1:00:00 PM Assembly

Voting Session

Assembly Chambers

http://www.njleg.state.nj.us/bills/BillView.asp?BillNumber=A1741

S716:

Greenstein, Linda R./Bateman, Christopher

"Thomas P. Canzanella Twenty First Century First Responders Protection Act"; concerns workers' compensation for public safety workers.

6/20/2019 1:00:00 PM Assembly

Voting Session

Assembly Chambers

http://www.njleg.state.nj.us/bills/BillView.asp?BillNumber=S716

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Updated: 06-15-2019

Updated: 06-15-2019

Wednesday, May 8, 2019

New Penalties Proposed for Employers

Employers who fail to maintain or file reports of accidents, wages, benefits to taxes will be subject having their license suspended or revoked under a proposed rule. The proposed rule published by The Department of Labor and Workforce Development (NJDOL) will empower NJ to strictly enforce compliance including compliance with the workers compensation law, NJSA 34:15-1, et seq.

Friday, April 12, 2019

NJ Monitors Wages: A Benefit for Injured Workers

NJ Labor Department’s recent crackdown on unscrupulous public

works Contractors will help injured workers obtain the correct benefit amounts

should they suffer a work-related accident. Workers’ compensation benefits are

based on wages at the time of the injury.

The New Jersey Department of Labor and Workforce

Development’s Wage and Hour Compliance Division has barred two public works

contractors from doing business in the state for violations in other

jurisdictions, heralding a tough and progressive new enforcement approach

against dishonest contractors.

The cases against drywall contractor P& B Partitions and

electrical contractor MJK Electrical Corp., both of West Berlin, were settled

last month, with each contractor agreeing to a temporary revocation of their

registration for violations outside prevailing wage law.

“As I have often said, working on public projects is a

privilege, not a right,” said Labor Commissioner Robert Asaro-Angelo. “These

cases signal a new and bold effort to ensure that privilege is extended only to

contractors who follow our laws, and pertinent laws in other jurisdictions.” P

& B Partitions’ two-year revocation follows a civil action in Massachusetts

in which the company allegedly failed to pay proper overtime, resulting in $158,139

in back wages and $42,350 in penalties as a result of a ULDOL investigation

under the Fair Labor Standards Act.

The case was a consequence of a Memorandum of Cooperation

signed by Asaro-Angelo and USDOL officials to solidify cooperation between the

two agencies and enhance the enforcement capabilities of state and federal

labor laws. In the case of MJK Electrical, the Labor Department’s enforcement

action followed a guilty plea by the firm’s vice president, George Peltz, to

federal tax evasion, failing to pay payroll taxes, theft from an employee

benefits plan, and unlawful payments to a union official.

The company, which indicated its intent to buy out Peltz,

agreed to a three-year registration revocation, ending in March of 2022. New

Jersey already has one of the strongest prevailing wage laws in the country.

The Public Works Contractor Registration Act, N.J.S.A. 34:11-56.48, et seq.,

requires all contractors, including named subcontractors, to register with the

Labor Department before submitting price proposals or engaging in public works

contracts exceeding the prevailing wage threshold of $15,444 for municipalities

and $2,000 for non-municipal work.

….

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters). For over 4 decades the Law Offices of Jon L Gelman 1.973.696.7900 jon@gelmans.com has been representing injured workers and their families who have suffered occupational accidents and illnesses.

Tuesday, December 18, 2018

NJ Senate passes bill to increase benefits for hand and foot claims

Yesterday the NJ Senate passed a bill (S782) to increase benefits for work-related hand and foot claims. The legislation also requires a study of the effectiveness of the state's workers' compensation system. The Assembly version of the bill has been referred to the Assembly Labor Committee.

Identical Bill Number: A1110

Last Session Bill Number: S777 A4376 Sarlo, Paul A. as Primary Sponsor Scutari, Nicholas P. as Primary Sponsor | ||||

| 1/9/2018 Introduced in the Senate, Referred to Senate Labor Committee 5/10/2018 Reported from Senate Committee, 2nd Reading 5/10/2018 Referred to Senate Budget and Appropriations Committee 9/24/2018 Reported from Senate Committee with Amendments, 2nd Reading 12/17/2018 Passed by the Senate (27-8) Introduced - - 10 pages PDF Format HTML Format Technical Review Of Prefiled Bill - - 9 pages PDF Format HTML Format Statement - SLA 5/10/18 - 1 pages PDF Format HTML Format Reprint - - 9 pages PDF Format HTML Format Statement - SBA 9/24/18 - 3 pages PDF Format HTML Format Fiscal Estimate - 10/3/18;1R - 4 pages PDF Format HTML Format Committee Voting: SLA 5/10/2018 - r/favorably - Yes {4} No {1} Not Voting {0} Abstains {0} - Roll Call SBA 9/24/2018 - r/Sca - Yes {10} No {0} Not Voting {1} Abstains {2} - Roll Call Session Voting: Sen. 12/17/2018 - 3RDG FINAL PASSAGE - Yes {27} No {8} Not Voting {5} - Roll Call | ||||

Sunday, September 23, 2018

NJ Legislature Advances Increase to Work Comp Benefits & Proposes System Study

On Monday, September 24, 2018, a NJ legislative committee, Senate Budget and Appropriations, took action on a sweeping workers' compensation proposal (S782) to increase benefits for the loss of a hand or foot and also establish a permanent study to review the efficiency and effectiveness of the entire NJ workers' Compensation system. The bill was reported out of committee and now will be voted on by the NJ Senate on September 27, 2018.

The committee vote was as follows:

SBA 9/24/2018 - r/Sca - Yes {10} No {0} Not Voting {1} Abstains {2} - Roll Call

Sarlo, Paul A. (C) - Yes Stack, Brian P. (V) - Yes Addiego, Dawn Marie - Abstain

Bucco, Anthony R. - Not Voting Cruz-Perez, Nilsa - Yes Cunningham, Sandra B. - Yes

Greenstein, Linda R. - Yes O'Scanlon, Declan J., Jr. - Yes Oroho, Steven V. - Yes

Pou, Nellie - Yes Ruiz, M. Teresa - Yes Thompson, Samuel D. - Abstain

Weinberg, Loretta - Yes

The committee vote was as follows:

SBA 9/24/2018 - r/Sca - Yes {10} No {0} Not Voting {1} Abstains {2} - Roll Call

Sarlo, Paul A. (C) - Yes Stack, Brian P. (V) - Yes Addiego, Dawn Marie - Abstain

Bucco, Anthony R. - Not Voting Cruz-Perez, Nilsa - Yes Cunningham, Sandra B. - Yes

Greenstein, Linda R. - Yes O'Scanlon, Declan J., Jr. - Yes Oroho, Steven V. - Yes

Pou, Nellie - Yes Ruiz, M. Teresa - Yes Thompson, Samuel D. - Abstain

Weinberg, Loretta - Yes

This bill increases the amount of workers' compensation paid in certain cases for the loss of a hand, or thumb and first and second fingers (on one hand) or four fingers (on one hand) or a foot, as follows:

1. If a loss of function of a hand is determined to be a 25% or more loss of use, the award of workers’ compensation shall be calculated based on a maximum of 300 weeks of compensation for a 100% loss of function; and

2. If a loss of function of a foot is determined to be a 25% or more loss of use, the award of workers’ compensation shall be calculated based on a maximum of 275 weeks of compensation for a 100% loss of function.

Under current law, the maximum award for the loss of a hand is 245 weeks and the maximum award for the loss of a foot is 230 weeks.

The bill also requires the Commissioner of Labor and Workforce Development to study, in consultation with the Commissioner of Banking and Insurance, the State’s workers’ compensation system and make recommendations that will help foster and maintain an efficient, effective and well-balanced workers’ compensation program that is equally responsive to the needs of both the State’s workforce and the employer community. The commissioner will submit a study, with recommendations, to the Governor and the Legislature not later than one year after the effective date of this bill and every five years thereafter. This bill was pre-filed for introduction in the 2018-2019 session pending technical review. As reported, the bill includes the changes required by a technical review, which has been performed.

…

Jon L. Gelman of Wayne NJ is the author of NJ Workers’ Compensation Law (West-Thomson-Reuters) and co-author of the national treatise, Modern Workers’ Compensation Law (West-Thomson-Reuters).

Updated: 9/25/18 10:42am

Updated: 9/25/18 10:42am

Wednesday, September 5, 2018

Totally Injured Workers Maybe Getting an Increase in Benefits

The proposed Trump Administration 2019 Budget (p. 115) may allow NJ workers’ compensation beneficiaries to receive an increase in benefits. By eliminating the Social Security “reverse offset,” totally and permanently injured NJ workers will receive a triennial annual COLA increase.

“The Budget includes a re-proposal to eliminate reverse offsets in fifteen states where Workers' Compensation (WC) benefits and temporary disability insurance benefits (TDI) are offset instead of DI benefits."

Wednesday, April 25, 2018

Equal Pay for Equal Work Now Law in New Jersey - Legislation Signed

NJ Governor Murphy Signs Historic, Sweeping Equal Pay Legislation that will balance the playing field for women receiving workers' compensation benefits for occupational injuries and illnesses.

Sunday, October 8, 2017

NASI Study: Employers & Employees Lose With Workers' Compensation

WASHINGTON, D.C. – Workers’ compensation employer costs as a share of payroll declined in 2015, reversing a four-year trend, and benefits as a share of payroll fell for the fourth straight year, according to a new report from the National Academy of Social Insurance (the Academy).

Friday, December 2, 2016

Insurance Rating Company Increases Estimate for Net Ultimate U.S. Asbestos Losses to $100 Billion

A.M. Best has increased its estimate for losses that U.S. property/casualty insurers can ultimately expect from third-party liability asbestos claims by approximately 18% to $100 billion. The $15 billion increase to the net ultimate asbestos loss estimate comes as insurers are incurring approximately $2.1 billion in new losses each year while paying out nearly $2.5 billion on existing claims. The updated figures are contained in a new Best’s Special Report, titled “A.M. Best Increases Estimate for Net Ultimate Asbestos Losses to $100 Billion.” The report also states that A.M. Best is not making any change to its $42 billion estimate on net ultimate environmental losses; therefore, A.M. Best’s view of ultimate industry losses for asbestos and environmental (A&E) is now $142 billion.

Monday, April 18, 2016

Creating a Competitive Economy: The Verizon Strike

|

| President Barack ObamaPhoto credit: Wikipedia |

On Friday President Obama issued an Executive Order to increase competition in the markets including healthcare and broadband. Most obviously directed to the issues raised by the Verizon strike over low wages, monopolistic activity, stifling technological

Wednesday, May 6, 2015

Professor John F Burton Jr: Illinois Proposed Changes Are Obectionable

The former chair of the 1972 National Commission on Workers' Compensation told the Illinois legislature yesterday that the proposed changes to the Illinois Workers' Compensation Act will degrade the system and reduce benefits to injured workers. Profession Emeritis John F. Burton, Jr., yesterday presented a statement to the Committee of the Whole before the Illinois House of Representatives.

|

| Professor John F. Burton Jr. |

Tuesday, April 22, 2014

Wage Theft -- Another Assault on Workers' Compensation

| As corporate American devises new methods to reduce wages it also assaults the injured workers' benefit safety net including workers' compensation insurance. It results in rate benefits to go down and premium bases to become inadequate to pay on gong claims. Today's post is shared from nytimes.com and is authored by it's Editorial Board. When labor advocates and law enforcement officials talk about wage theft, they are usually referring to situations in which low-wage service-sector employees are forced to work off the clock, paid sub minimum wages, cheated out of overtime pay or denied their tips. It is a huge and under policed problem. It is also, it turns out, not confined to low-wage workers. In the days ahead, a settlement is expected in the antitrust lawsuit pitting 64,613 software engineers against Google, Apple, Intel and Adobe. The engineers say they lost up to $3 billion in wages from 2005-9, when the companies colluded in a scheme not to solicit one another’s employees. The collusion, according to the engineers, kept their pay lower than it would have been had the companies actually competed for talent. The suit, brought after the Justice Department investigated the anti-recruiting scheme in 2010, has many riveting aspects, including emails and other documents that tarnish the reputation of Silicon Valley as competitive and of technology executives as a new breed of “don’t-be-evil” bosses, to cite Google’s informal motto. The case... [Click here to see the rest of this post]  Workers' Compensation: Would Higher Minimum Wage for ... Workers' Compensation: Would Higher Minimum Wage for ...Apr 17, 2014 Wages determine rates of workers' compensation. The lowest wage earners go unnoticed in the struggle to increase benefits. Today's post is shared from njspotlight.com . Advocates decry current $2.13 per hour as unfair, ... http://workers-compensation.blogspot.com/ Payroll Data Shows a Lag in Wages, Not Just Hiring Feb 11, 2014 But the report also made plain what many Americans feel in their bones: Wages are stuck, and barely rose at all in 2013. They were up 1.9 percent last year, or a mere 0.4 percent after accounting for inflation. Not only was that ... http://workers-compensation.blogspot.com/ McDonald's Accused of Stealing Wages From Already ... Mar 16, 2014 McDonald's Accused of Stealing Wages From Already Underpaid Workers. Wage are the basic factor upon which to calculate rates for workers' compensation purposes. Today's post was shared by Mother Jones and comes ... http://workers-compensation.blogspot.com/ |

Sunday, March 16, 2014

McDonald's Accused of Stealing Wages From Already Underpaid Workers

Today's post was shared by Mother Jones and comes from www.motherjones.com

Wage-theft suits brought against McDonald's this week in Michigan, California, and New York accuse the chain of refusing to pay overtime, ordering people to work off the clock, and straight up erasing hours from timecards. If these allegations are true, and maybe they're not, but maybe they are, then the company has been illegally screwing people who are already being legally screwed. This is the most recent development in a months-long campaign by fast-food workers pushing for a $15/hour starting wage. You shouldn't eat fast food because fast food is bad for you but if you do eat fast food (and you will eat fast food at least once in a while because nobody can be perfect all the time), be nice to the people who serve you. They have to fight tooth and nail to make ends meet. Could you make it on fast food wages? Here's a depressing calculator. (Spoiler: Probably not!) |

Wednesday, February 19, 2014

World Trade Center Fund Now Covers Myeloid Malignancies

Beginning on February 1, 2014, the World Trade Center (WTC) Health Program began considering blood or bone marrow disorders of the myeloid line to be slow-growing blood cancers. Accordingly, they will be considered WTC-related health conditions, making them available for WTC Health Program medical treatment services for eligible members.

These cancers had been considered non-malignant by the Administrator because they were referred to as “pre-leukemic” hematopoietic disorders in the medical literature. Recent scientific advances, however, characterize these “pre-leukemic” myeloid neoplasms as slow-growing blood cancers, and authoritative scientific sources now consider them to be malignant myeloid neoplasms.

After receiving a request from the WTC Clinical Centers of Excellence to review certain myeloid disorders in terms of their status as malignancies, the WTC Health Program has determined that, in addition to types of leukemias, these myeloid malignancies are eligible for coverage by the WTC Health Program as WTC-related health conditions.

The group of myeloid malignancies includes the following health conditions:

(1) Myelodysplastic Syndromes (MDSs);

(2) Myeloproliferative neoplasms (MPNs);

(3) Myelodysplastic/myeloproliferative neoplasms (MDS/MPN); and

(4) Myeloid malignancies associated with eosinophilia and abnormalities of growth factor receptors derived from platelets or fibroblasts.

On January 2, 2010, President Barack Obama signed the James Zadroga 9/11 Health and Compensation Act establishing the World Trade Health Program and extends and expands eligibility for compensation under the September 11th Victim Compensation Fund of 2001.

For over 3 decades the Law Offices of Jon L. Gelman 1.973.696.7900 jon@gelmans.com have been representing injured workers and their families who have suffered asbestos related disease. Please contact our office if you require assistance in filing a claim under the newly enacted James Zadroga 9/11 Health and Compensation Act.

These cancers had been considered non-malignant by the Administrator because they were referred to as “pre-leukemic” hematopoietic disorders in the medical literature. Recent scientific advances, however, characterize these “pre-leukemic” myeloid neoplasms as slow-growing blood cancers, and authoritative scientific sources now consider them to be malignant myeloid neoplasms.

After receiving a request from the WTC Clinical Centers of Excellence to review certain myeloid disorders in terms of their status as malignancies, the WTC Health Program has determined that, in addition to types of leukemias, these myeloid malignancies are eligible for coverage by the WTC Health Program as WTC-related health conditions.

The group of myeloid malignancies includes the following health conditions:

(1) Myelodysplastic Syndromes (MDSs);

(2) Myeloproliferative neoplasms (MPNs);

(3) Myelodysplastic/myeloproliferative neoplasms (MDS/MPN); and

(4) Myeloid malignancies associated with eosinophilia and abnormalities of growth factor receptors derived from platelets or fibroblasts.

On January 2, 2010, President Barack Obama signed the James Zadroga 9/11 Health and Compensation Act establishing the World Trade Health Program and extends and expands eligibility for compensation under the September 11th Victim Compensation Fund of 2001.

For over 3 decades the Law Offices of Jon L. Gelman 1.973.696.7900 jon@gelmans.com have been representing injured workers and their families who have suffered asbestos related disease. Please contact our office if you require assistance in filing a claim under the newly enacted James Zadroga 9/11 Health and Compensation Act.

Related articles

- OSHA announces proposed new rule to improve tracking of workplace injuries and illnesses (workers-compensation.blogspot.com)

- 'Bakers contract cancer from asbestos in old ovens': tv programme (workers-compensation.blogspot.com)

- Why Everyone Seems to Have Cancer (workers-compensation.blogspot.com)

- CMS Takes a New Direction in the Proposed MSP Appeal Process (workers-compensation.blogspot.com)

- Obama to Raise Minimum Wage for Federal Contractors, Asserting Executive Power (workers-compensation.blogspot.com)

- The 50-year war on smoking (workers-compensation.blogspot.com)

Friday, October 25, 2013

Sued Over Pay, Condé Nast Ends Internship Program

For Lauren Indvik, a business editor and soon-to-be co-editor in chief at Fashionista, the 2008 internship at Vogue was worth every sacrifice.

The 15 pounds frantically lost in the weeks before the interview. The predawn drive from New Hampshire to Times Square. The bed shared with a fellow penny-pinching friend near Pennsylvania Station, and the morning and evening walks — in heels — because she could not afford subway fare. “It’s so valuable,” she said. |

Subscribe to:

Posts (Atom)